Congo’s Chamber of Mines head sees more M&A due to covid-19

The coronavirus pandemic will drive a “survival of the fittest” in Democratic Republic of Congo’s mining sector and trigger an increase in deal-making, the president of the DRC Chamber of Mines said on Wednesday.

“I see an increase in M&A activities post-covid-19 where the big players are shopping around for opportunities,” Louis Watum, who is also managing director of DRC operations at Ivanhoe Mines, said in a virtual panel discussion.

Boris Kamstra, director of Pangea Exploration and executive director at Alphamin Resources, which manages the Bisie tin mine in Congo’s North Kivu region, echoed that view.

MINING COMPANIES’ EQUITIES HAVE BEEN RE-SET PRACTICALLY ACROSS THE GLOBE AND THAT DOES OFFER ONE A SLIGHTLY LOWER BARRIER TO ENTRY

“Mining companies’ equities have been re-set practically across the globe and that does offer one a slightly lower barrier to entry … so absolutely our radars are out and (we) are scratching around wherever we think there may be some potential,” he said.

Amedeo Anniciello, CEO at Standard Bank DRC, said the bank could provide capital for deals partly thanks to its partnership with Industrial and Commercial Bank of China (ICBC).

“Through them, we have a huge corridor of funding into this market,” he said. “We are able to attract funding for the mining sector, because of the high presence of Chinese entities in the DRC mining environment.”

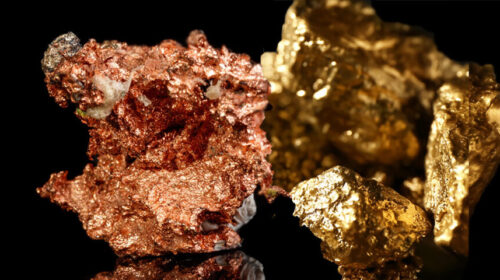

Congo has $24 trillion of value in mineral resources, Anniciello added.

Chinese-owned companies make up a large proportion of the smaller and mid-tier miners in the Congo. Among the biggest mining companies are Glencore, China Molybdenum, Barrick, AngloGold Ashanti, MMG Limited, Ivanhoe Mines, and Eurasian Resources Group.

The pandemic has, however, caused difficulties accessing mining supplies, Kamstra said.

“The world is currently running on inventory that it built up in the past. At some point that inventory is going to run a bit thin,” he said.